EDGE AMC Growth Fund

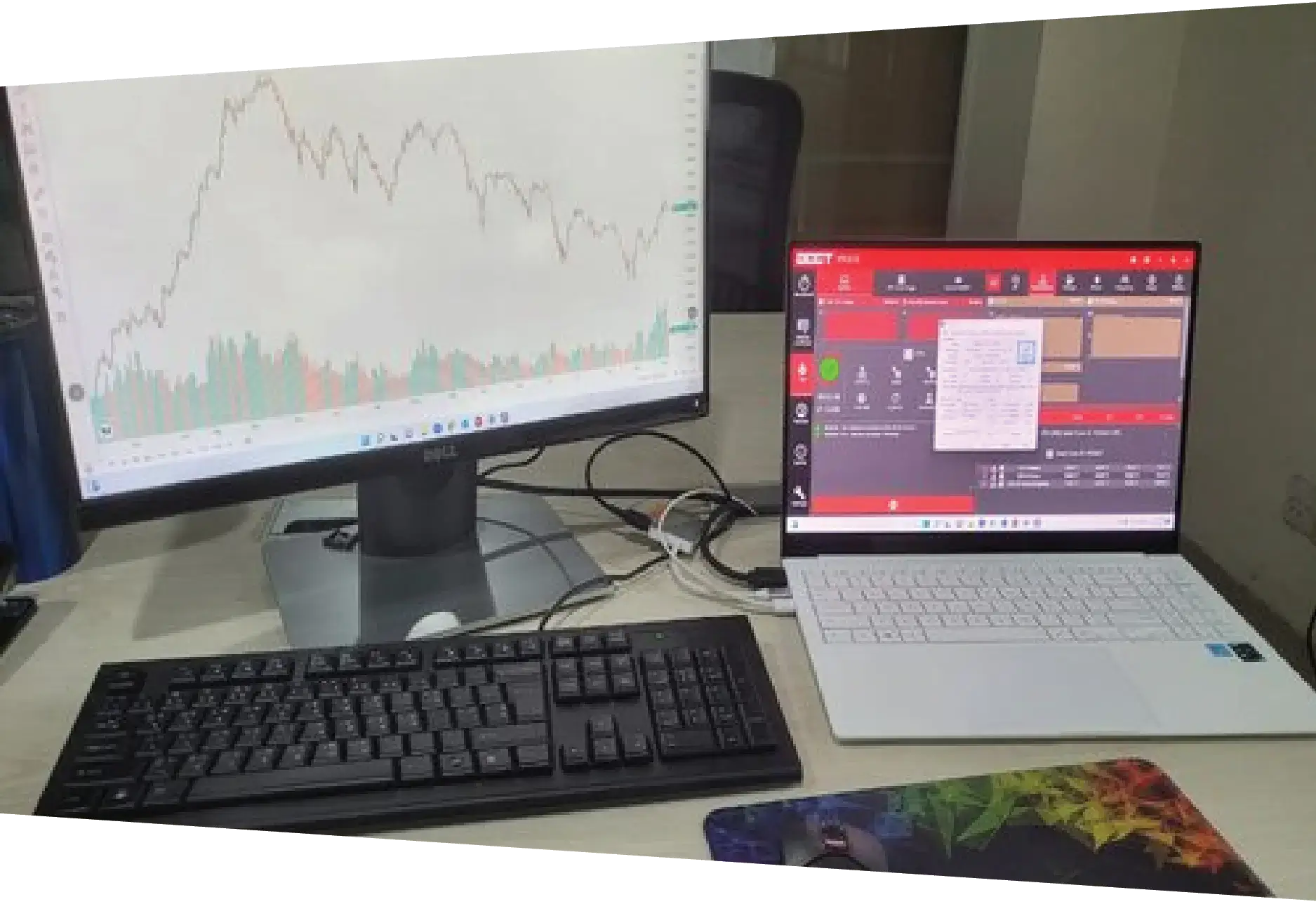

EDGE AMC Growth Fund (EDGEAMCGF) features a larger allocation to equity investments. The company and sectoral concentrations are also higher than a balanced fund. The fund is expected to be more volatile than our balanced fund but can provide higher returns over a long investment horizon.

EDGEAMCGF is best suited for investors with a long investment horizon and higher risk appetite and tolerance.

Invest Now Contact us