Choosing the Right Mutual Fund | Part 1

By Fateen Tahseen Alam

Analyst

EDGE AMC Limited

Posted on: 24 Dec, 2023

One good aspect of Mutual Funds is that the low-upfront capital requirement and convenient access to them make it possible for almost anyone to invest in them. However, which type of mutual fund would be more appropriate for someone will depend on the expectations and plan of the person in question.

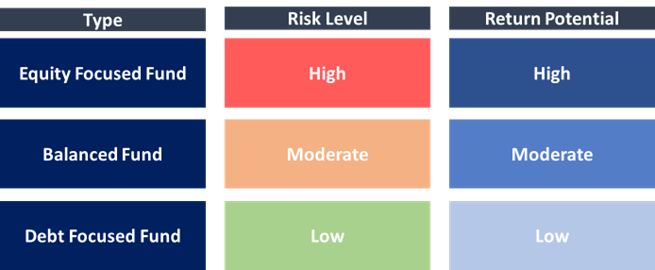

The suitability of a fund will narrow down to primarily the risk level an investor is willing to undertake; in other words, an investor’s risk appetite. Because different asset management companies offer personalized mutual funds to varying degrees, the filtering to find the appropriate fund will differ from AMC to AMC based on personal preference. But, in general, the risk levels of mutual funds are broadly based on three categories—

- Equity-focused funds

- Debt-focused funds, and

- Balanced funds

The more equity-concentrated a fund is, the riskier it is. Likewise, the more debt-concentrated a fund is, the less risky it is. Balanced funds, that is, funds with almost equal concentrations in both equity and debt securities, will represent moderate levels of risk. Ideally, an investor’s risk appetite will match the risk level of mutual funds. That is why someone who wants more certain and less volatile returns will go for debt-focused/fixed-income funds most likely, and, on the other hand, someone targeting volatility-driven higher returns will go for equity-focused funds.

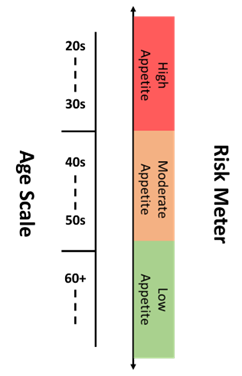

Although the risk level or capacity of a person depends on their available capital and short-term needs, as an evidence-backed rule of thumb—the younger one is, the more risk they should be able to take, and the older one is, the less risk they should be able to take. The reason behind this is that in your younger years such as the 20s and 30s, you have more time to earn, less money to lose, and fewer as well as smaller expenses in general. And as you get into older age brackets such as your late 40s and beyond, the time available to you to make money will decrease, but you’ll likely have accumulated a relatively sizeable amount of wealth over the span of your working years that will require conservative handling as that will be the sole means for more significant expenses for most people in their late years.

Other than risk appetite, long-term plan is another key determinant in filtering for appropriate funds. Here, long-term plan refers to the target amount one aims to reach over a certain period for whatever purpose it may be. Ultimately, the suitable fund or portfolio allocation will be the middle ground between one’s risk appetite and long-term target amount. For example, someone planning to reach a somewhat sizable amount of money over a short period but having a low-risk appetite will most probably match with a balanced fund variant that invests almost equally in equities and fixed-income securities but with a higher exposure to equities.

Continue to Part 2.

To learn more about mutual funds, you may read our guide on mutual fund investing.

Click here to explore our mutual funds.

- Tags:

- Mutual fund, investing, saving, risk appetite

Search

Categories

Recent Post

-

EDGE Government Security Index (EDGEGSI) Starts 2025 with Strongest January Gain Since 2010

18 Feb, 2025 -

Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

03 Oct, 2024 -

Bangladesh Equity Market Outlook: Low Valuations and Future Growth Potential Amid Political and Economic Uncertainty

02 Oct, 2024 -

Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

29 Sep, 2024 -

Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

28 Sep, 2024

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.